Observatory on Fintech & Sustainability

Fintech & Sustainability, a possible combination.

Among the topics that represent a particular focus in the 2025/2026 biennium, Femtech and Longevitech certainly represent not only important technological frontiers, but real pillars. For an inclusive and sustainable innovation, in which health, longevity and economic well-being intertwine to create a lasting intergenerational impact.

The Observatory’s work on these topics saw the realisation of a first major event on 19 November 2024, which will be followed by other important initiatives at national and international level.

Fintech & Sustainability, a likely match

Fintech & Sustainability, a possible combination

Rethinking banking, financial and insurance services in terms of broadening the user base, including players until recently considered ‘unbankable’, is now made possible by the wave of innovations that is affecting, and radically transforming, the financial sector.

Fintech

Fintech – a term that describes the marriage between Finance and Technology – is in fact giving rise to new products and services, redefining modes, times and costs of use and designing more horizontal and inclusive business models. All this is happening through the use of artificial intelligence (AI), machine learning and the internet of things.

These changes are taking place in a period of intense demographic and social transformation, characterised, at least in Europe, by a declining population and generalised ageing, which is, however, being offset by the arrival of a generally young migrant population.

Sustainable Innovation

Sustainable Innovation

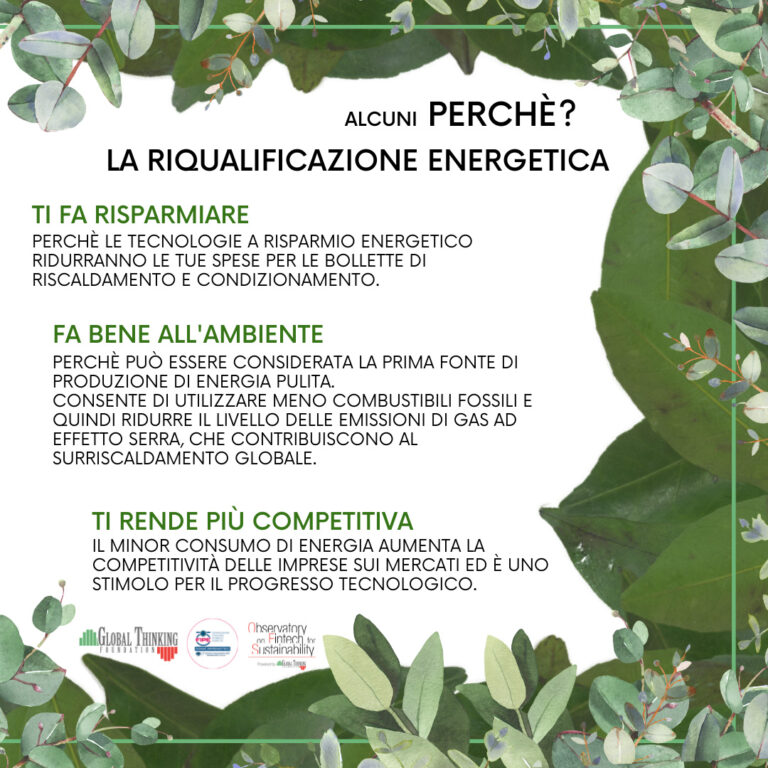

Sustainable innovation, also in the financial field, is an objective that to be so today must be feasible not only from an economic point of view. Indeed, it is no longer possible to think about the application of new digital technologies in the financial sphere without integrating concerns about the environmental impacts and social effects they may directly or indirectly generate. In this scenario, fintech has great potential for achieving a more sustainable and inclusive development, within the framework represented by the UN 2030 Agenda for Sustainable Development and the Sustainable Development Goals (SDGs).

Finance for Sustainability

The areas of interaction between Fintech and sustainability are numerous (many of which are still being tested) and range from Finance for Sustainability, aimed at directing financial resources to support investments with positive environmental and social impacts, to the application of blockchain technology to guarantee security and quality in the supply chain, but also circularity in the use of resources, or to help reduce carbon emissions.

An International look

The Fintech & Sustainability Observatory of the Global Thinking Foundation is a platform for different stakeholders to meet and exchange ideas. We want to create a lasting bridge between Fintech and Sustainable Development.

Through the Observatory, GLT adds a further piece to its action on the issues of social inclusion and empowerment of the most fragile members of society.

Global Focus

After the intense activity promoting financial literacy for women, young people and the elderly in Italy, the assistance to over-indebted students in the United States and the initiatives in favour of women in France, the Observatory on Fintech for Sustainability broadens Global Thinking Foundation’s gaze to the East, regularly participating in the Singapore Fintech Festival – SFF, and in the main events in the Middle East and in all those places of innovation par excellence in the FinTech sphere, and which have made the issue of economic sustainability a political and social priority.

KEY WORDS

The digitalization of financial services opens uncharted territories for sustainable development

Contemporary cities are the ideal lab for research and experimentation on sustainable innovation

Financial inclusion leverages individual independence with positive outcomes on national economies

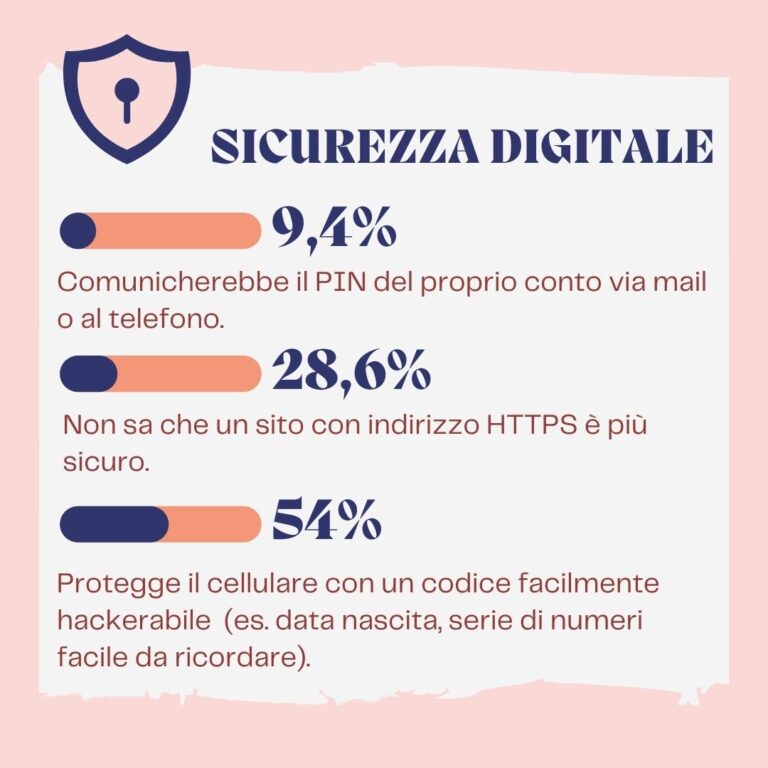

Financial alphabetization is strictly linked to financial knowledge

Sustainable innovation can only spread from an active collaboration between actors of the financial ecosystem towards mutual goals

Fintech can help tackle Sustainable Development Goals, that are the backbone of the UN 2030 Agenda for Sustainable Development

2024 Observatory Events

PARTICIPANTS IN THE OBSERVATORY